Plan Overview

Your wealth implementation plan appears to be on track for your retirement goals, with a projected accumulated wealth of approximately SGD 19,517,525 by your retirement age of 65. This aligns with your target monthly expenses of SGD 50,000 in retirement. However, it's important to note that your plan anticipates a depletion of funds by the end of your expected life span, which is a common outcome in retirement planning.

Key Observations & Considerations

- Your initial investment of SGD 100,000 is a solid starting point, and the projected growth over the years indicates a strong accumulation of wealth, assuming the return rates hold true.

- The assumptions used in your projection, including a 4% return rate both pre- and post-retirement, are conservative. It may be beneficial to review these assumptions periodically to ensure they remain realistic given market conditions.

- With a retirement age of 65, you have a 30-year investment horizon, which is advantageous for compounding growth. However, consider how inflation may impact your purchasing power over time, especially with a monthly expense target of SGD 50,000.

- Since you have not specified any additional investment goals or cash flows, it may be worthwhile to consider diversifying your financial strategy to include other potential income sources or savings vehicles.

Suggested Next Steps

- Review your current investment strategy and consider whether your asset allocation aligns with your risk tolerance and long-term goals.

- Schedule a meeting with your Endowus Client Advisor to discuss your assumptions and explore potential adjustments to your investment strategy as you approach retirement.

- Consider setting up a regular review of your financial plan to account for changes in your circumstances, market conditions, and inflation, ensuring your retirement plan remains robust.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

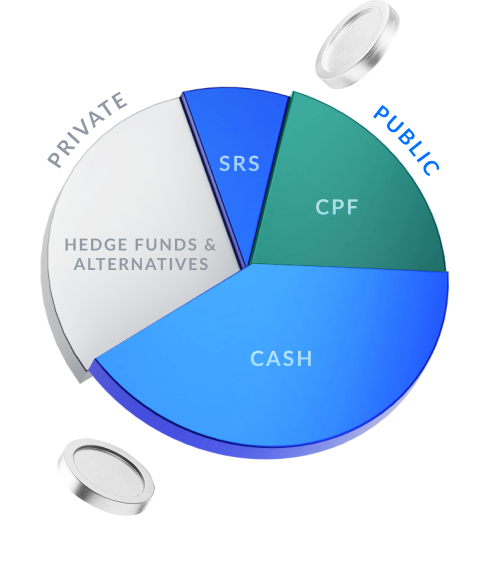

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.