Plan Overview

Your wealth implementation plan indicates a solid trajectory towards your retirement goal of SGD 1,951,752 by age 65. However, with no initial investments or external investments currently in place, the monthly contribution of approximately SGD 2,979 may be challenging to sustain without additional funding sources. It's essential to evaluate your cash flow and consider how to meet this contribution requirement effectively.

Key Observations & Considerations

- The plan assumes a consistent monthly contribution of SGD 2,979, which is significant given your current age of 35 and the absence of initial investments. It's crucial to assess your ability to maintain this contribution over the next 30 years.

- The projected return rates of 4% pre- and post-retirement are conservative, which is generally prudent. However, consider whether these assumptions align with your risk tolerance and investment strategy, especially in the context of Singapore's market conditions.

- With a retirement age set at 65, you have a 30-year investment horizon, which is beneficial for compounding growth. However, ensure that your investment strategy is diversified to mitigate risks associated with market volatility.

- The plan anticipates that your accumulated wealth will be nearly depleted by the end of your expected life span, which is a common outcome in retirement planning. This aligns with your goal of funding monthly expenses of SGD 5,000 in retirement.

Suggested Next Steps

- Review your current cash flow situation to determine how you can consistently meet the monthly contribution of SGD 2,979. Consider potential sources of additional income or savings.

- Evaluate your investment strategy to ensure it aligns with your long-term goals and risk tolerance. Diversification can help manage risks and enhance potential returns.

- Schedule a meeting with your Endowus Client Advisor to discuss your plan in detail, including any adjustments needed to your contributions or investment strategy to ensure you remain on track for your retirement goals.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

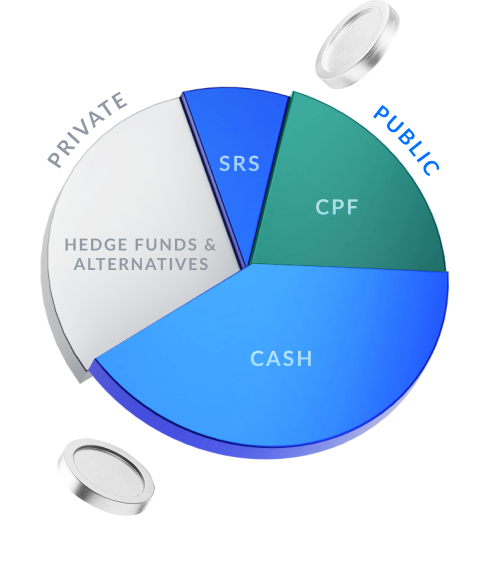

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.