Plan Overview

Your wealth implementation plan indicates a solid trajectory towards your retirement goal of SGD 1,951,752 by age 65. However, with no initial investments or external cash flows currently factored in, the plan relies heavily on future contributions to meet your monthly retirement expenses of SGD 5,000. It's crucial to assess the feasibility of your monthly contribution of approximately SGD 2,979, especially given the projected negative cash flow towards the end of your retirement.

Key Observations & Considerations

- The absence of initial investments or external cash flows means your plan is entirely dependent on future contributions. This could be a significant risk if your income fluctuates or if unexpected expenses arise.

- Your projected retirement expenses of SGD 5,000 per month are substantial, and while your plan shows growth, the reliance on a consistent monthly contribution of SGD 2,979 may need to be evaluated for realism based on your current financial situation.

- The assumptions used, including a 4% return rate both pre- and post-retirement, are conservative. It may be beneficial to explore whether these assumptions align with your risk tolerance and investment strategy.

- Given your current age of 35 and a retirement age of 65, you have a 30-year investment horizon. This is a significant period for growth, but it also requires careful planning to ensure that you can sustain your contributions over time.

Suggested Next Steps

- Consider reviewing your current financial situation to identify any potential initial investments or external cash flows that could be included in your plan to enhance its feasibility.

- Evaluate your monthly contribution amount of SGD 2,979 to ensure it aligns with your income and expenses. If necessary, adjust your retirement goals or explore ways to increase your income.

- Schedule a meeting with your Endowus Client Advisor to discuss your plan in detail, including your investment strategy and how to best position yourself to meet your retirement goals.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

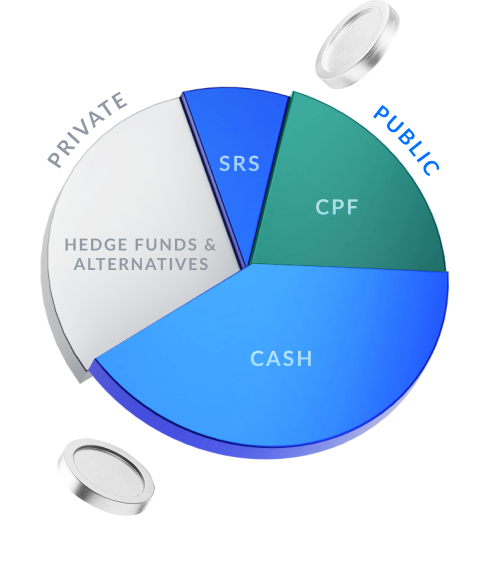

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.