Plan Overview

Your wealth implementation plan indicates a solid trajectory towards your retirement goal of SGD 3,903,505 by age 65, with a monthly expense target of SGD 10,000. However, the projection shows that your accumulated wealth will nearly deplete by the end of your expected lifespan, which is a common outcome in retirement planning. It's important to consider how your current contributions and investment strategies align with your long-term financial goals.

Key Observations & Considerations

- Your plan assumes a consistent monthly contribution of approximately SGD 5,958, which is essential to reach your retirement target. Given that you currently have no initial investments or external investments, it's crucial to evaluate how you will sustain these contributions over the next 30 years.

- The projected return rates of 4% pre- and post-retirement are conservative, which is prudent given the current market conditions. However, it may be beneficial to review these assumptions periodically to ensure they remain realistic and aligned with market trends.

- With a retirement age set at 65, you have a 30-year investment horizon. This is a significant period that allows for potential growth, but it also requires careful planning to ensure that your investments are diversified and positioned to meet your future needs.

Suggested Next Steps

- Consider reviewing your monthly contribution strategy to ensure it is feasible and sustainable over the long term. If necessary, explore ways to increase your income or reduce expenses to meet your contribution goals.

- Schedule a meeting with your Endowus Client Advisor to discuss your investment strategy and ensure that your portfolio is diversified and aligned with your retirement goals.

- Keep track of your financial progress and adjust your assumptions as needed, especially in light of changing market conditions or personal circumstances.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

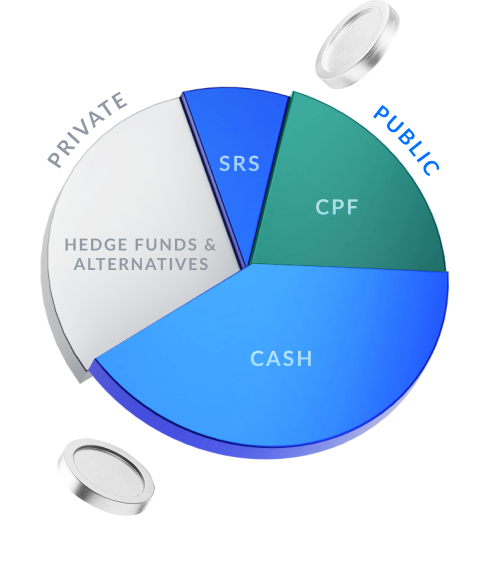

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.