Plan Overview

Your wealth implementation plan indicates a solid trajectory towards your retirement goal of SGD 1,951,752 by age 65. However, with no initial investments or external investments currently in place, the plan relies heavily on future contributions. The projected accumulated wealth shows a positive growth trend, but the absence of a financial buffer may pose challenges in achieving your desired monthly expenses in retirement.

Key Observations & Considerations

- The plan assumes a consistent monthly contribution of approximately SGD 2,979, which is essential for reaching your retirement target. It's important to ensure that this amount is feasible within your current financial situation.

- With a retirement age set at 65, you have a 30-year investment horizon, which is generally favorable for growth. However, the lack of initial investments means that your growth will be entirely dependent on future contributions and market performance.

- The projected return rate of 4% is conservative, which is prudent given market volatility. However, consider reviewing your investment strategy to ensure it aligns with your risk tolerance and long-term goals.

- The absence of any external investments or cash flows could limit your flexibility. It may be beneficial to explore additional income sources or investment opportunities to enhance your financial security.

Suggested Next Steps

- Review your current financial situation to confirm that the monthly contribution of SGD 2,979 is sustainable and consider adjusting your budget if necessary.

- Explore potential investment options or external income sources that could provide additional financial support, especially as you approach retirement.

- Schedule a meeting with your Endowus Client Advisor to discuss your plan in detail, including strategies for diversifying your investments and optimizing your retirement savings.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

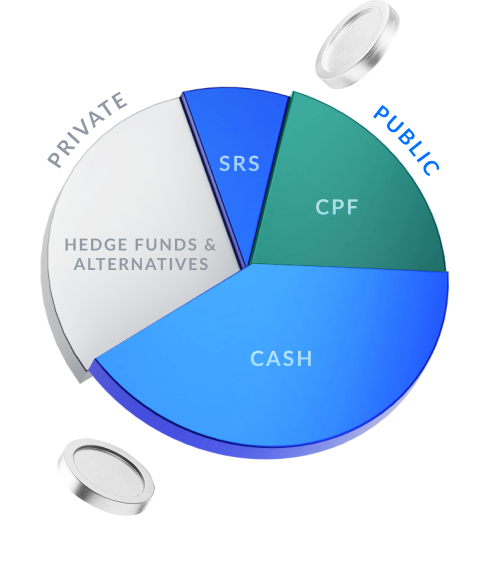

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.