Plan Overview

Your current wealth implementation plan indicates that you are on track to meet your retirement goal of SGD 1,000 per month starting at age 65. However, the projection shows that you will need to contribute approximately SGD 2,542 monthly to reach your target retirement sum of SGD 390,350. It's important to consider the implications of your short-term goal of providing an inheritance to your children, which may require adjustments to your overall strategy.

Key Observations & Considerations

- Your retirement plan anticipates a monthly expense of SGD 1,000, which is a realistic figure, but ensure that this aligns with your expected lifestyle and inflation adjustments over time.

- The short-term goal of providing an inheritance of SGD 400,000 by 2027 may impact your ability to contribute towards your retirement savings. Balancing these goals is crucial.

- The projected return rates of 4% pre- and post-retirement are conservative, which is generally prudent, but consider whether this aligns with your risk tolerance and investment strategy.

- With no initial investments or external investments currently declared, it may be beneficial to explore options to build a foundation for your retirement savings.

Suggested Next Steps

- Review your monthly contributions and assess if the SGD 2,542 is feasible within your current financial situation, especially considering your short-term inheritance goal.

- Consider setting up a structured plan to achieve your inheritance goal while ensuring it does not detract from your retirement savings.

- Schedule a meeting with your Endowus Client Advisor to discuss your overall financial strategy, including how to balance your retirement and inheritance goals effectively.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

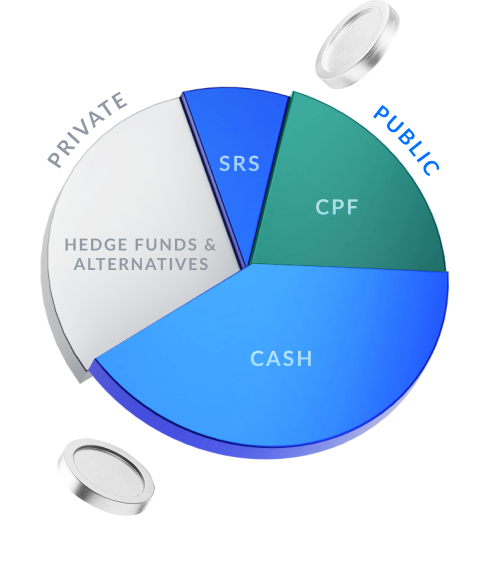

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.