Plan Overview

Your retirement plan appears to be on track, with a projected accumulated wealth of SGD 1,561,402 by your retirement age of 65. This aligns closely with your target retirement sum, indicating that your current investment strategy is effectively set to meet your anticipated monthly expenses of SGD 4,000 in retirement. However, it's important to consider the sustainability of your plan, especially as you approach retirement.

Key Observations & Considerations

- Your initial investment of SGD 100,000 is a solid foundation, and the projected growth over the years shows a healthy accumulation of wealth, primarily driven by the assumed return rate of 4%.

- The plan assumes a consistent return rate and inflation rate, which are critical factors. It's essential to regularly review these assumptions as market conditions can fluctuate, potentially impacting your investment growth.

- With no additional contributions planned, your strategy relies heavily on the growth of your initial investment. Consider how you might increase your contributions or diversify your investments to enhance your financial security in retirement.

- The projection indicates that your funds will be nearly depleted by the end of your expected life span, which is typical in retirement planning. This reinforces the importance of monitoring your expenses and adjusting your lifestyle as needed.

Suggested Next Steps

- Review your investment strategy to ensure it aligns with your risk tolerance and long-term goals, especially as you approach retirement age.

- Consider increasing your contributions or exploring additional investment opportunities to bolster your retirement savings.

- Schedule a meeting with a financial advisor to discuss your plan in detail, including potential adjustments to your assumptions and strategies for managing expenses in retirement.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

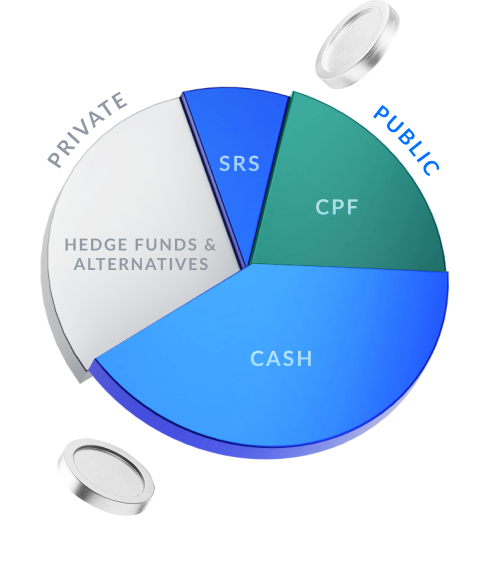

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.