Plan Overview

Your current wealth implementation plan indicates that you are planning to retire at age 36 with a monthly expense of SGD 3,000. However, the projection shows a significant negative accumulated wealth starting from your first year of retirement, indicating that the plan is not feasible with the current inputs. Immediate attention is needed to reassess your financial strategy to ensure a sustainable retirement.

Key Observations & Considerations

- The projected monthly expenses in retirement of SGD 3,000 translate to a total required retirement sum of approximately SGD 1,206,514. Without any initial investments or contributions, this target is unattainable.

- The model assumes a conservative return rate of 4% both pre- and post-retirement, which may not be sufficient given the high monthly expenses and the lack of accumulated wealth.

- With no current investments or cash flows indicated, the plan lacks a foundation for growth, making it critical to explore potential contributions or external investments to support your retirement goals.

- The timeline for retirement is very short, with only one year until you plan to retire. This limited time frame necessitates immediate action to either increase contributions or adjust retirement expectations.

Suggested Next Steps

- Review your current financial situation and consider any potential sources of income or investments that could be included in your retirement plan.

- Reassess your retirement age and monthly expenses to determine if adjustments can be made to create a more feasible plan.

- Schedule a meeting with your Endowus Client Advisor to discuss your financial goals and explore strategies for building a sustainable retirement plan.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

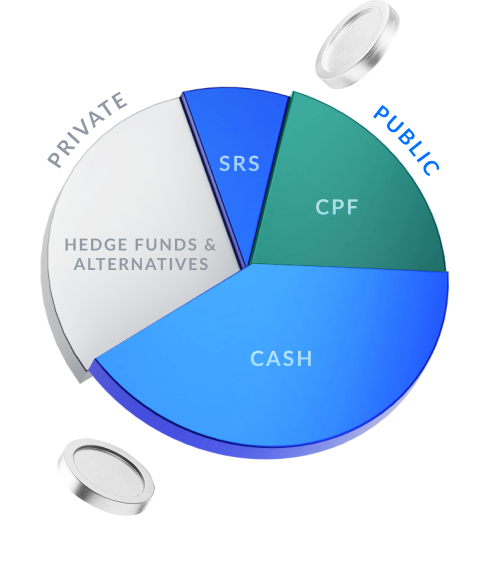

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.