Plan Overview

Your wealth implementation plan appears to be on a positive trajectory, with a projected accumulated wealth of SGD 1,246,375 by your retirement age of 66. This amount aligns with your target retirement sum, allowing for monthly expenses of SGD 4,000 for 20 years. However, it's important to note that the plan relies heavily on consistent investment growth and contributions leading up to retirement.

Key Observations & Considerations

- The projected return rate of 4% pre- and post-retirement is relatively conservative. It may be beneficial to review your investment strategy to ensure it aligns with your risk tolerance and long-term goals, especially given the current economic environment.

- Your initial investment of SGD 10,000 is a solid start, but consider how additional contributions or external investments could enhance your growth potential as you approach retirement.

- With a retirement age set at 66, you have a substantial investment horizon of 21 years. This allows for potential market fluctuations, but it also emphasizes the importance of maintaining a diversified portfolio to mitigate risks.

Suggested Next Steps

- Review your current investment strategy and consider increasing your monthly contributions if feasible, to bolster your retirement savings further.

- Schedule a meeting with your Endowus Client Advisor to discuss your investment goals and explore options that may better align with your risk profile and retirement timeline.

- Keep an eye on inflation and adjust your retirement expenses accordingly to ensure your projected monthly expenses remain realistic over time.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

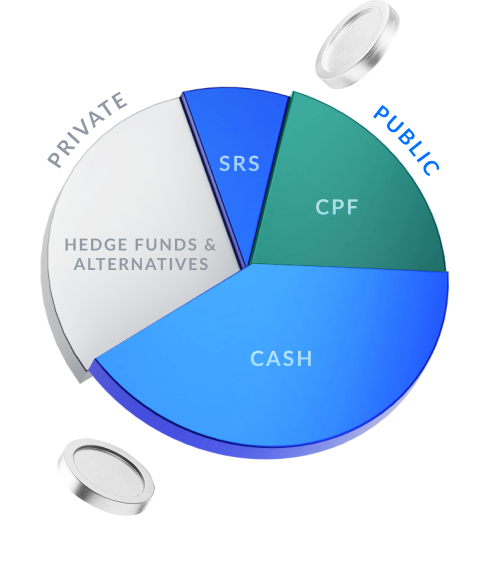

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.