Plan Overview

Your wealth implementation plan appears to be on a promising trajectory, with a clear structure for achieving your short, mid, and long-term goals. However, the projection indicates that your accumulated wealth will not fully cover your anticipated retirement expenses, suggesting a need for adjustments in your contributions or investment strategy to ensure financial stability in retirement.

Key Observations & Considerations

- Your plan includes a mix of short-term, mid-term, and long-term goals, which is a strong approach to financial planning. However, ensure that your investment strategy aligns with the time horizons of these goals to optimize growth.

- The projected return rates of 4% pre- and post-retirement are conservative. Given the current market conditions, it may be beneficial to review these assumptions and consider a diversified investment strategy that could potentially yield higher returns.

- With a retirement age set at 65, you have a substantial investment horizon ahead. This allows for the potential to recover from market fluctuations, but it also emphasizes the importance of regular reviews of your investment allocations and contributions to stay on track.

Suggested Next Steps

- Consider scheduling a meeting with your Endowus Client Advisor to discuss your current investment strategy and explore options to enhance your portfolio's growth potential.

- Review your monthly contributions and assess if there are ways to increase them, especially in light of your projected expenses in retirement.

- Keep an eye on inflation and adjust your target amounts for your goals accordingly, particularly for your short-term and mid-term objectives, to ensure they remain realistic.

External Investments

| Account/Investment Name | Type | Platform/Institution | Current Value |

|---|---|---|---|

| Vanguard S&P500 ETF | Equities | Fidelity | SGD 25,000 |

Future Cash Inflows

| Inflow Name | Year | Amount | Adjusts for Inflation |

|---|---|---|---|

| inheritance | 2065 | SGD 110,000 |

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

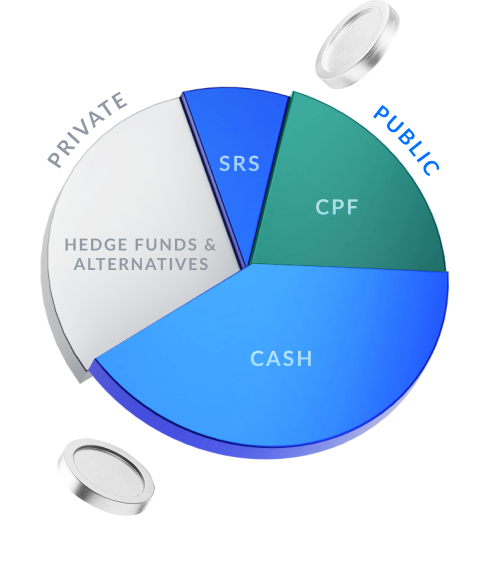

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.