Plan Overview

Your wealth implementation plan appears to be on a solid trajectory, with a significant initial investment of SGD 100,000 and a clear outline of your financial goals. However, the projection indicates that while you are on track to meet your retirement needs, the accumulated wealth is projected to run out just before the end of your expected life span, which is a common outcome in retirement planning. This suggests a need for careful consideration of your ongoing contributions and potential adjustments to your investment strategy.

Key Observations & Considerations

- Your retirement age of 54 gives you a substantial investment horizon of 30 years, allowing for potential growth of your initial investment. However, the projected monthly expenses of SGD 4,000 in retirement will require careful planning to ensure sustainability throughout your retirement years.

- The goals you have set, including a travel fund and a new car, are well-defined and adjusted for inflation, which is crucial for maintaining their value over time. However, ensure that these goals do not compromise your retirement savings.

- The assumed return rates of 4% pre- and post-retirement are conservative, which is prudent, but it may be beneficial to explore ways to enhance your investment returns, especially given the long time horizon before retirement.

- Your plan does not currently account for any cash flows or additional contributions beyond the initial investment, which could significantly impact your ability to meet your goals. Consider how you might incorporate regular contributions or other income sources into your plan.

Suggested Next Steps

- Review your current investment strategy to ensure it aligns with your long-term goals and risk tolerance, especially as you approach retirement.

- Consider setting up a regular contribution plan to supplement your initial investment, which can help bolster your retirement savings and provide a buffer against inflation.

- Schedule a meeting with your Endowus Client Advisor to discuss your financial goals in detail and explore potential adjustments to your plan that could enhance your financial security in retirement.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

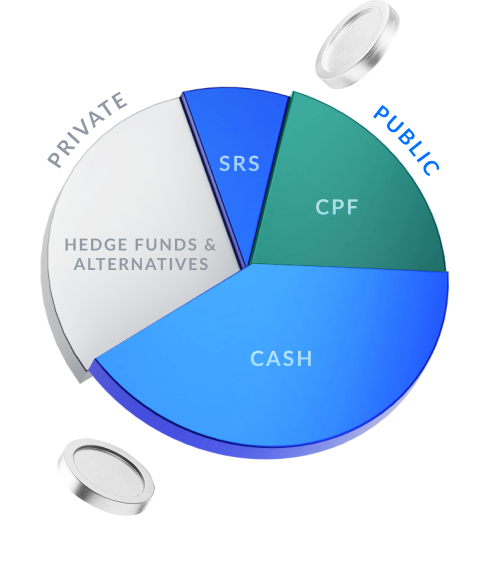

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.