Plan Overview

Your retirement plan aims to provide a monthly income of SGD 5,000 for 21 years starting at age 65, requiring a total retirement sum of approximately SGD 1,951,752. Currently, you have no initial investments or external investments, and your monthly contribution of approximately SGD 2,979 is essential to reach your target. However, without any existing assets, it may be challenging to meet your retirement goals solely through contributions.

Key Observations & Considerations

- The projected retirement sum of SGD 1,951,752 is based on a monthly expense of SGD 5,000, which is a realistic figure, but achieving this amount will require consistent contributions over the next 30 years.

- With no initial investments or external investments, your plan heavily relies on your ability to contribute SGD 2,979 monthly. Consider how feasible this contribution is within your current financial situation.

- The assumptions used for inflation and investment returns (2.08% inflation and 4% returns) are conservative, which is prudent, but it’s important to regularly review these assumptions as market conditions change.

- Given your current age of 35 and a retirement age of 65, you have a long investment horizon, which is beneficial for compounding growth. However, it’s crucial to ensure that your contributions are sustainable throughout this period.

Suggested Next Steps

- Evaluate your current financial situation to determine if the monthly contribution of SGD 2,979 is realistic and sustainable. Consider any potential changes in income or expenses that may affect this.

- Consider setting up an emergency fund or initial investments to kickstart your retirement savings, as having some capital can significantly impact your long-term growth.

- Schedule a meeting with your Endowus Client Advisor to discuss your retirement goals in detail and explore strategies to enhance your investment plan, including potential investment vehicles that align with your risk tolerance.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

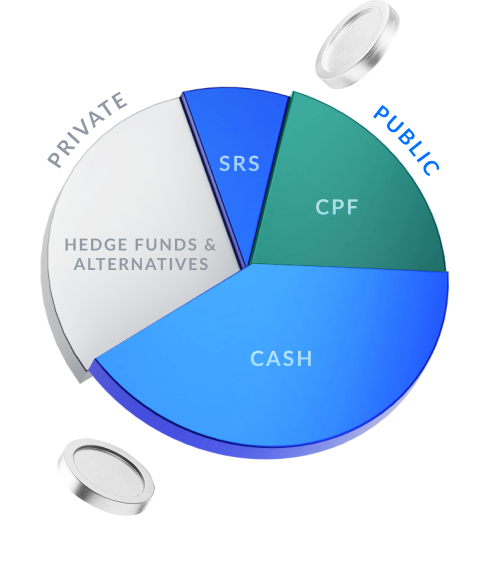

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.