Plan Overview

Your current wealth implementation plan indicates that to retire at age 60 with a monthly expense of SGD 10,000 for 26 years, you will need a target retirement sum of approximately SGD 4,441,888. However, the projection shows that your accumulated wealth is expected to go negative before retirement, suggesting that the current plan may not be feasible without additional funding sources or adjustments.

Key Observations & Considerations

- The projected monthly contribution of approximately SGD 11,695 is significant, especially considering your current age of 32. It may be beneficial to assess whether this amount is realistic given your current financial situation and income.

- Your investment goals span short, mid, and long-term horizons, which is a positive approach to financial planning. However, the feasibility of achieving these goals should be evaluated in light of your overall financial picture and the potential need for adjustments to your contributions or timelines.

- The assumed return rates of 4% pre- and post-retirement are conservative, which is prudent. However, it is essential to consider whether these assumptions align with your risk tolerance and investment strategy, especially in the context of inflation adjustments for your goals.

- The negative accumulated wealth projection indicates that there may be a need to explore additional funding sources or investment strategies to ensure that your retirement plan remains on track.

Suggested Next Steps

- Review your current financial situation to determine if the projected monthly contribution of SGD 11,695 is feasible and consider how you might adjust your budget or income to meet this goal.

- Schedule a meeting with your Endowus Client Advisor to discuss your investment strategy and explore options for funding your retirement and achieving your investment goals more effectively.

- Consider revisiting your investment goals and timelines to ensure they are realistic and aligned with your overall financial plan, especially in light of the projected negative wealth accumulation.

Wealth Projection

Your financial future visualized. Updates as you provide information.

Set up your wealth plan

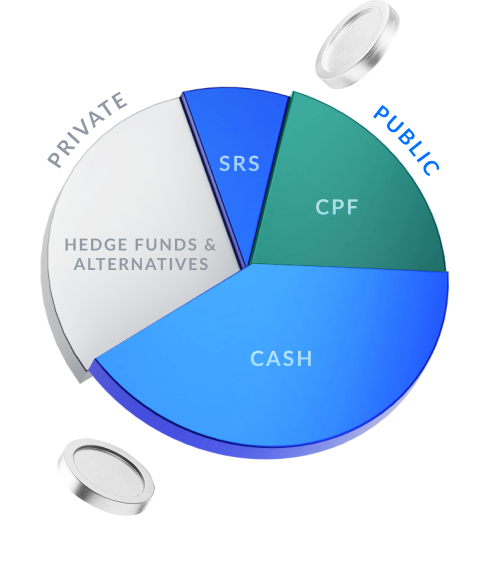

Wealth Allocation

How your total wealth goals are allocated. You can filter by goal type.

Define your first investment goal to see how your wealth could be allocated.